Average gross domestic product (GDP) growth in Africa is second only to that of South Asia. The improvement of macroeconomic and public sector management since the 1990s is widely praised. Substantial investment in infrastructure is now among the most pressing priorities. Public debt levels are mostly well below 50% of GDP, a rule of thumb being that 40% is sustainable in emerging economies. Global investors’ hunt for yield has enabled many African countries to tap international bond markets for the first time. While Eurobond issues are often depicted as evidence of the continent’s economic resurgence, they should also encourage close scrutiny of public financial management and debt sustainability. Against a backdrop of falling commodity prices, the US dollar’s strength and forecasts for higher global interest rates, this Counterpoint highlights the pitfalls of rising debt levels in Africa and underscores measures for mitigating risk.

By Paul Adams

The 1996 Heavily Indebted Poor Countries (HIPC) Initiative, supplemented by the 2005 Multilateral Debt Relief Initiative (MDRI), cancelled about US$100bn of debt in 30 African countries in exchange for economic reforms. By 2014, 21 African countries had credit ratings issued by international agencies, more than double the number a decade earlier. Fast-growing African economies have gained access to international bond funds seeking higher-yield investments in emerging economies and portfolio diversification. Demand intensified as interest rates tumbled in developed economies after the 2008 financial crisis.

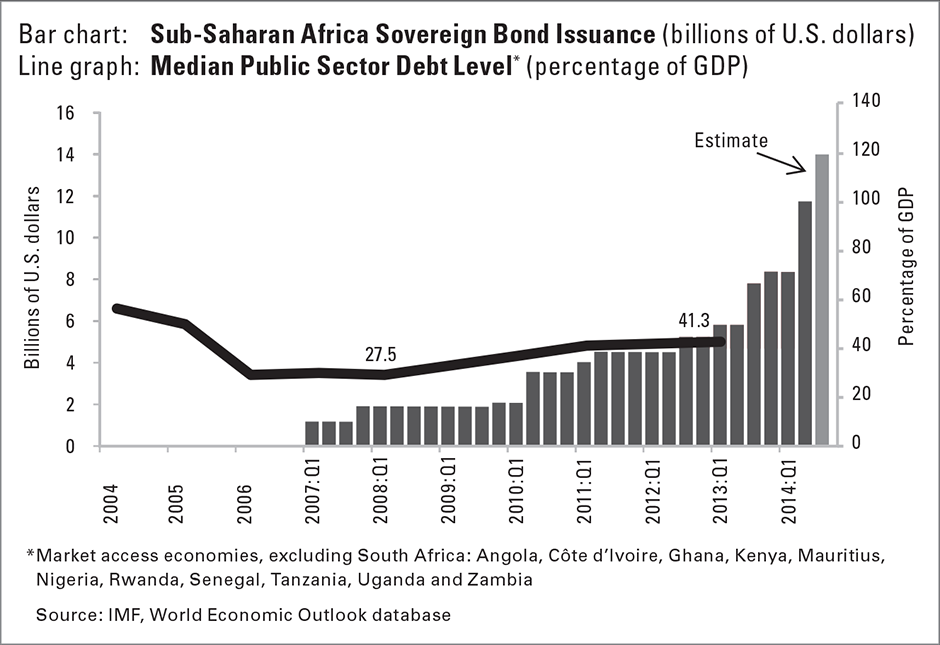

In 2014, new bond issues from Zambia, Kenya, Côte d’Ivoire, South Africa, Senegal and Ghana had raised almost US$7bn by the end of the third quarter, bringing the cumulative total since 2006 to US$25.8bn. Yields on some African issues are similar to those of southern European states, seemingly indicating a low risk of default. The coupon on Ethiopia’s US$1bn issue in December 2014 was 6.625%. Although one of the 10 fastest-growing economies in the world, Ethiopia also has debt levels forecast to exceed 50% in 2014-15, a depreciating currency and scant foreign exchange reserves.

Borrowers and investors seem equally pleased with the deal. Borrowers can raise funds for infrastructure, general purposes or debt rescheduling at rates far lower than those offered by undeveloped local bond markets – and with longer maturity. Investors appear unperturbed about lending to African countries with credit ratings “deep into the ‘junk’ range”.1 Most issues have been comfortably over-subscribed.

Borrowers and investors seem equally pleased with the deal. Borrowers can raise funds for infrastructure, general purposes or debt rescheduling at rates far lower than those offered by undeveloped local bond markets – and with longer maturity. Investors appear unperturbed about lending to African countries with credit ratings “deep into the ‘junk’ range”.1 Most issues have been comfortably over-subscribed.

An implicit assumption prevails that there is little danger of African countries going bust. While there is no immediate likelihood of widespread sovereign default, the nature and consequences of financial mismanagement in Ghana – a flag-bearer for the “Africa rising” narrative – should not be ignored. Debt levels do not have to match those of developed economies to trigger an economic crisis.

Africa needs to spend US$360bn on infrastructure by 2040, according to the African Development Bank (AfDB). Ghana, Senegal and Zambia are among the countries that have issued sovereign bonds to pay for infrastructure development. Competition for funds is global, and funding will be needed from diverse sources. Sovereign bonds are one alternative to concessional loans from donors. “African governments have been able to shop around in a way that wasn’t previously possible,” says David Cowan, Africa economist at Citi. Diversification of borrowing sources is evidence of sensible management of public debt. Funds can be invested in assets and institutions that will support economic growth and generate taxes to service the debt.

The use of sovereign bonds in debt restructuring and rescheduling can have a positive effect on a country’s debt profile. An issue puts a country “on the radar” of international debt markets. Since 2006, Côte d’Ivoire, Gabon, the Republic of Congo and Seychelles have used international bond issues in debt rescheduling. All of these countries had – unusually in Africa – borrowed heavily from the private sector; restructuring the debt in a Eurobond made repayment more straightforward and lowered interest rates.

In larger, more developed economies, a sovereign debt issue also provides a benchmark to assist the expansion of local bond markets and borrowing by domestic banks and companies on international markets. “The original purpose of Nigeria’s 2011 issue was to price Nigerian risk internationally because the benchmark for commercial debt is sovereign risk,” says Femi Edun, managing director of Frontier Capital in Lagos. The purpose of Kenya’s 2014 US$2bn Eurobond issue was similar. The government was keen to prove that it could successfully launch a large international bond issue and for the issue to provide a stimulus to the local debt market.

Diversification of borrowing sources is evidence of sensible management of public debt

Debt levels are rising in Africa, in some cases rapidly. Long term domestic and international commercial borrowing was forecast to rise by about 50% in 2014. As early as April 2012 a World Bank economist observed that the eight African countries to have borrowed fastest since receiving debt relief – Ghana, Uganda, Senegal, Niger, Malawi, Benin, Mozambique, and São Tomé and Príncipe – “could within a decade be back to pre-debt relief debt stock levels”. Rising debt-to-GDP ratios have been mitigated by upward revisions of GDP in Ghana, Kenya and Uganda. But the cost of external financing looks set to increase just as economic growth slows. At the end of 2014, yields on most African Eurobonds were at record highs.2

In May 2014, International Monetary Fund (IMF) Managing Director Christine Lagarde cautioned African governments against “overloading with too much debt”.3 “When some African countries go to the bond market, they’re exposing themselves to market discipline which they don’t understand. You can see the results with Ghana,” a government adviser in Uganda, which has decided against issuing a Eurobond for the time being, told ARI. “Zambia doesn’t have the discipline either. I’d say that African bond issuance has outstripped government capacity to manage the debt.”

International bond investors impose no conditions on how funds are spent by sovereign borrowers, unlike multilateral and bilateral lenders. A bond prospectus may state that the proceeds will be allocated to infrastructure development or debt rescheduling, but this is not always the case – and any mention of a use of funds is non-binding. “Once they’ve issued a Eurobond, and US$1bn or so rolls in, they can spend it how they like. That is what got Ghana into trouble,” says a Ghanaian debt specialist. The country’s 2007 US$750m issue was earmarked for infrastructure but then mostly used for general budgetary purposes. Fungibility – using funds for a different purpose than originally stated – may not concern investors unduly, but it should concern legislators and citizens.

Currency risk is often underestimated. The cost of servicing a US dollar-denominated Eurobond may look cheaper than that of a debt issue in local markets, but if the national currency declines the cost of foreign borrowing rises. In 2000-13, average annual currency depreciation in sub-Saharan Africa was 3-4%, amounting to 44%cumulatively. According to an IMF study, the cost to the Ghanaian Treasury of servicing an equivalent debt in local markets – had there been sufficient capacity – would have been less than that of both the 2007 and 2013 dollar-denominated bond issues.4

Currency risk is often underestimated

Vulnerability to currency risk increases if the borrower is dependent on the exports of one or two commodities for revenue and foreign exchange. Copper accounts for 70% of Zambia’s exports and earns one-third of its foreign exchange. When the price of copper fell sharply between January and April 2014, jeopardising revenue, the Zambian kwacha fell by one-third in a similar timeframe. In June, the country approached the IMF to discuss an economic reform programme – just two months after launching a US$1bn bond issue at 8.5%, compared to 5% for its 2012 issue. The kwacha subsequently recovered and the copper price did not fall further. Annual GDP growth of 6-7% in 2014-16 and a peak government debt level of 33% of GDP are forecast. Despite the stabilised outlook, Zambia’s experience of economic volatility and its vulnerability to shocks during 2014 should not be ignored by other sovereign borrowers.

The requirement to service debt is immediate and delays in expenditure on infrastructure can be costly. Debt service and the economic rate of return on the investment are not always given adequate consideration and they assume greater importance in the case of large loans. Zambia had paid millions of dollars in interest on its 2012 US$750m Eurobond issue before it began to spend the money on power, road, railways, hospitals and funding small and medium-sized enterprises. Given the consensus outlook for rising global interest rates over the next decade, loan repayment and rollover risk are added concerns. “We don’t think the Ministry of Finance has laid out a payback plan, two years after the first Eurobond,” Albert Halwampa of the Zambia Institute for Policy Analysis and Research (ZIPAR) commented soon after Zambia’s second issue was launched in 2014. “No one is saying how we are going to pay back the money when debts mature in 2022 and 2024.”

The lack of conditionality attached to a sovereign Eurobond issue is alluring for African borrowers, as is the speed with which an issue can be packaged and launched, in comparison to funding from a multilateral or bilateral donor. But “they are more costly if you fail than going to the World Bank or AfDB,” warns a government adviser in Uganda. Furthermore, the World Bank and IMF maintain that “international sovereign bonds may not be the best option for financing infrastructure investment,” 5 and recommend concessional finance – or a combination of concessional, public-private partnership and syndicated loans instead.

The lack of conditionality attached to a sovereign Eurobond issue is alluring for African borrowers

The issuance of international sovereign bonds to commercial investors exposes a defaulting borrower to specific legal risks, notably from “vulture funds”. The International Capital Markets Association, IMF and AfDB are studying ways to mitigate the risks of “collective action” during sovereign debt restructuring. This danger was recently underscored by a September 2014 New York court judgement in favour of a debt fund against Argentina, which is seeking to restructure its external debt in the wake of its 2001 financial crisis and US$95bn debt default. Some of the “holdout” creditors – US hedge funds – who own the remainder of the defaulted bonds sued Argentina in 2011 for principal and past-due interest claims of US$1.6bn. “There is a system for private-sector debt default – bankruptcy,” says Amir Shaikh at the AfDB’s African Legal Support Facility. “But there is no system for sovereign default – sovereigns aren’t supposed to default. We’re looking at Argentina as a sort of test case.”

Disciplined debt management is crucial, based on sound institutions able to manage risk. Before negotiating debt relief in 2005, Nigeria established a budget office and debt management office (DMO). The country has a widely respected central bank. “If you’re going to borrow aggressively you need a good DMO,” says Bode Agusto, the founder of Nigeria’s first domestic debt-rating agency who set up the government’s Budget Office in the early 2000s. “Originally, it was to enable us to get debt relief. Now it helps to ensure that the level of debt is sustainable.” While Nigeria’s public debt level is small, at about 12% of GDP, this does not diminish the importance of professional debt management – for local as well as international debt. “The Nigerian government owes a lot to local borrowers,” explains Agusto, “and the ‘Nigeria Club’ doesn’t forgive anybody.”

Elsewhere in Africa, David Cowan at Citi suggests that sovereign borrowers could usefully learn from Botswana that “dull but sound” has merits. “In Botswana they evaluate every proposed loan with a proper cost-benefit analysis of the projects they’ll undertake with the money and work out whether the benefits will service the debt,” says Cowan. “South Africa is also sensible about debt,” he adds. Cowan is critical of the widespread reliance on the World Bank and IMF to carry out debt sustainability reviews since debt relief. “I’d prefer to see borrower countries do that themselves. It’s a basic duty of government to work out what they can borrow sustainably.”

Skilled planning and project management is essential to secure projected returns from investment in infrastructure. “You have to have projects for which you have already done a feasibility study, your engineering design and your costings so that you know you can service the debt and are ready to go as soon as you have the money,” says William Kalema at international advisory and accounting firm BDO in Uganda. “The foreign financiers don’t do this. The borrower must do the preparation. Secondly, you have to implement the projects to tight deadlines and spend tightly so you don’t overshoot the budget.” The design and implementation of “shovel-ready” projects “needs engineers, planners and economists”, Kalema emphasises. Crucially, he adds, “you also need someone who understands that spending isn’t the same thing as development.”

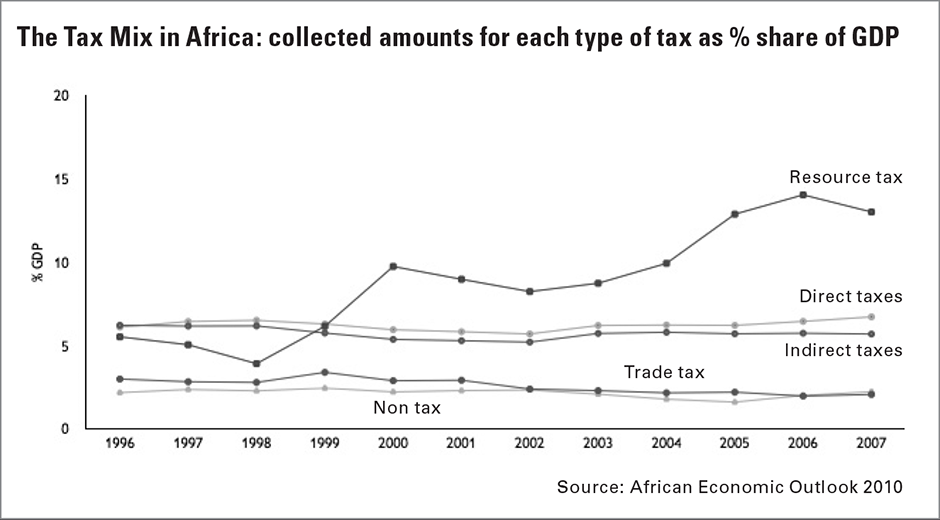

Domestic resource mobilisation – tax collection – needs to be maximised, particularly in countries with high budget deficits. Ghana would not need to borrow so heavily on international debt markets if it were to increase its tax-to-GDP ratio from the current 16% to a figure comparable with neighbouring Côte d’Ivoire (18%) or Togo (23%). Similarly Zambia, where tax revenue accounts for 19% of GDP, lags behind Zimbabwe at 26%, Botswana at 30% and Namibia at 32%. States which have worked to secure higher domestic taxation have established more sustainable revenue streams than those that relied on taxes and levies generated by the commodities boom. While taxes from resource extraction in Africa increased their contribution to GDP more than threefold between 1998 and 2006, from 4% to 14%, the contributions of other forms of tax revenue have stagnated. Direct personal and corporate taxation, and indirect taxes like VAT, both remained at about 6% of GDP. Trade taxes and duties declined from 3% to 2% of GDP. 6 Countries that rely on taxing domestic businesses and citizens rather than revenue from oil or mining exports, such as Rwanda and Kenya,

may prove to be the most reliable borrowers.

The potential of local currency debt markets should not be ignored. Although most borrowing in Africa is external, many countries raise the majority of their funding in domestic debt markets. African local debt stock rose from US$150bn to about US$400bn in 2004-14, a sum which dwarfs that raised by Eurobond issues. 7 In 2014, Standard & Poor’s forecast that 80% of commercial borrowing by the 17 sub-Saharan African countries it assigns a credit rating would be raised locally. 8 At present there are only 15 investable local bond markets on the continent. Many lack the size, length of yield curve, liquidity or currency stability to satisfy offshore investors; access to others remains restricted or closed for foreign investors, especially in the CFA franc zone. According to forecasts by South African bank Investec, African fixed-income markets could raise as much as US$500bn in the next five years. 9 But unless domestic savings rates are boosted, Africa will remain substantially dependent on international capital to finance infrastructure and current account deficits.

The potential of local currency debt markets should not be ignored

In Kenya and Nigeria, the growth of banks, insurance companies and pension funds is strengthening local debt markets. In 2012, Nigerian local debt was admitted to J.P. Morgan’s Government Bond Index-Emerging Markets (GBI-EM). The International Finance Corporation, part of the World Bank, and the AfDB have begun to issue naira-denominated bonds to improve liquidity in local capital markets. Nigeria launched an over-the-counter trading platform in 2013 to make a secondary market in local debt. However, even in Nigeria, sub-Saharan Africa’s largest economy, the local currency bond market remains underdeveloped, representing only 7% of GDP compared to more than 50% of GDP in South Africa.

While current debt levels in Africa are manageable, the consequences of the speed with which debt has been accumulated and the management of government borrowing and expenditure are causing concern. The role of the IMF in the region is increasing again. While its involvement can be interpreted as evidence of prudence and a constructive ongoing relationship in some countries, in others it is depicted as raising the spectre of a new phase of debt relief and even structural adjustment.

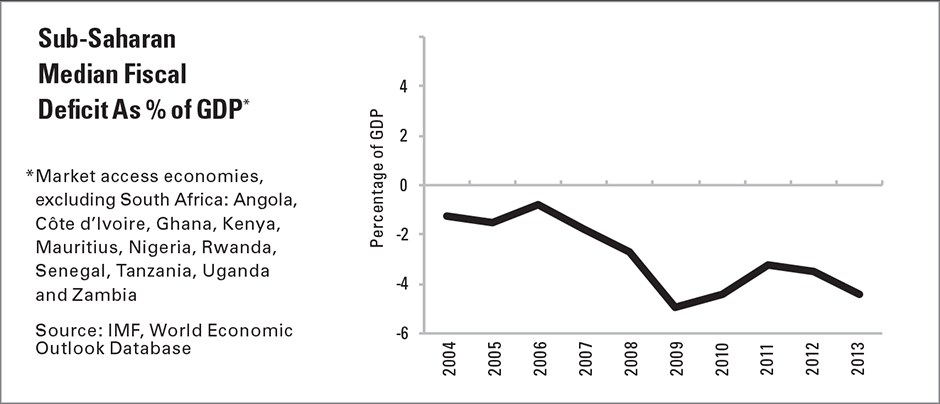

Unsustainable increases in government expenditure, often linked to the electoral cycle, are becoming more commonplace. “If you have real GDP growth of 6-7% you can sustain a budget deficit of 3-4% of GDP, especially if the deficit has a bias towards investment-driven spending. But if the deficit rises to around 7% of GDP or higher for a couple of years it is bound to get you into trouble,” says David Cowan at Citi. The end of quantitative easing programmes in advanced economies, the strength of the US dollar, China’s economic slowdown and lower commodity prices will all magnify the consequences of overspending.

The importance of developing and maintaining strong institutions to control spending, manage debt and maximise domestic revenue collection cannot be overstated. This is no easy task in countries with substantial new income from natural resources or volatile trade revenue. While external technical assistance is readily available, donor-funded “capacity building” is not always constructive or productive. In the eyes of recipients, assistance is often an imposition, inflexible, oblivious to the prevailing political economy and over-reliant on the input of western advisers on short-term contracts. There is scope for considerably greater intra-African advisory co-operation and exchange of knowledge. “The [Zambian] government should seek assistance from places such as the Macro Economic and Financial Management Institute of Eastern and Southern Africa”, says Albert Halwampa at ZIPAR. “There is a lack of expertise at what is known as ‘the middle office'”.

Unsustainable increases in government expenditure, often linked to the electoral cycle, are becoming more commonplace

The merits of conventional sources of borrowing have been overshadowed by the attractions of sovereign bonds. Syndicated bank loans are a commercial alternative, and concessional finance from official donors remains available, even as many African countries join the middle-income category. Nigeria recently accepted concessional loans worth US$945m from the World Bank, repayable in 20 years with an interest rate including costs of 2%. The AfDB asserts that its most important contribution is to introduce co-financing to its projects – from other official development partners or the private sector – and act as a “shop window” for Africa’s large-scale investment opportunities. New bilateral lenders have emerged since 2000, especially Brazil and China which, for example, accounts for more than one-third of Mozambique’s debt stock. Greater diversity of lenders is welcome, but diversification should not be at the expense of pragmatic and transparent financial management.

Funds raised by governments are public money. In keeping with their constitutional mandate, legislators need to exercise vigorous oversight and demand transparency about debt terms and spending plans. The Public Affairs and Budget Committees in the Tanzanian legislature exemplify the potential influence of parliamentary scrutiny. Albert Halwampa at ZIPAR suggests that in Zambia “parliament should scrutinise the whole [borrowing] process”. He explains: “We follow debt sustainability frameworks set out by the IMF and World Bank. A few months ago the finance minister went to parliament to raise the debt ceiling. The legal framework for state borrowing isn’t quite clear.” In November 2014, Auditor General Edward Ouko, the Parliamentary Budget Office and MPs rejected the Kenyan government’s proposal to raise the country’s debt ceiling by 50% – to 53% of GDP after it was rebased in September – until further details about spending plans and returns on investment were provided. Ouko publicly warned that such a move “will mortgage Kenyans for the next 50 years”.

In 2007, Ghana was the first African beneficiary of debt relief to tap the international bond markets, launching a US$750m 10-year issue. In 2014, despite a 60% upward revision of GDP, which elevated it to middle-income status, Ghana became the first beneficiary to return to the IMF for a three-year rescue package including up to US$1bn to allay a balance-of-payments crisis.

The discovery of oil and rapid economic growth spurred Ghana to raise loans that increased indebtedness to a higher level than pre-HIPC. The proceeds were not invested in infrastructure or reforms that would sustain GDP growth and generate the extra revenue to service the debt. Instead, the government vastly increased public-sector salaries, which now account for 70% of the budget. At the same time, the anticipated oil revenue was delayed and state mismanagement of the energy sector led to acute power shortages. Import costs and volumes rose steeply, leaving Ghana with a double-digit current account deficit, a budget deficit of 9.5% of GDP and public debt amounting to 60% of GDP in 2014.

By 2014, Ghana’s high GDP growth – which reached 14.5% in 2011 – could no longer mask the unsustainable state of the country’s finances. The cedi had declined nearly 40% against the US dollar by August, following a 24% slide in 2013. GDP growth slowed to less than 5%.

Assistance from the IMF enabled Ghana to launch its third Eurobond in September 2014. The issue had a 12-year maturity and raised US$1bn at 8.125% – compared to 5.625%, 6.875% and 6.625% for the 2014 issues by Côte d’Ivoire, Kenya and Ethiopia respectively. The cedi stabilised. In effect, the success of an unconditional bond issue was dependent on conditional IMF support, requiring cuts in public spending amounting to 3.5% of GDP that include civil service pay restraint, elimination of inefficient energy subsidies, and higher tax revenues to curb Ghana’s twin deficits.

Ghana entered into three-year support programmes with the IMF in 1999, 2003 and 2009. The current negotiations with the IMF are being led not by the current Finance Minister, Seth Terkper, but by a distinguished predecessor, Dr Kwesi Botchwey, the architect of Ghana’s economic reform programme in the 1980s.

1 FastFT, Financial Times, Dec. 3rd 2014

2 Thomas, Mark R., “Africa debt since debt relief: how clean is the slate?”, World Bank blog, April 10th 2012

3 “IMF warns ‘rising’ African nations on sovereign debt risks”, Financial Times, May 29th 2014

4 IMF, Regional Economic Outlook: Sub-Saharan Africa, October 2014, pp.16-17

5 IMF, African Department (Series) 14/02, Issuing International Sovereign Bonds, p.1 Opportunities and Challenges for Sub-Saharan Africa

6 Data from www.africaneconomicoutlook.org

7 Sulaiman, Tosin, “African local bonds – an untapped opportunity?”, Financial Times beyondbrics blog, October 15th 2014

8 Standard & Poor’s “Ratings Direct, Sub-Saharan African Sovereign Debt Report”, February 27th 2014, p.2

9 Sulaiman, Tosin, “African local bonds – an untapped opportunity?”, Financial Times beyondbrics blog, October 15th 2014